Lower the Cost of Flood Insurance

Just because your home or building is in the floodplain does not mean that you can’t reduce your flood insurance premiums. In fact, your building may have been built in a way that increases the cost of your annual premiums.

Your insurance premiums can be reduced by:

- Elevating utilities to the flood protection elevation

- Installing flood openings

- Elevating the structure to the flood protection elevation

- Relocating your home outside the regulatory floodplain

FEMA has prepared a brochure to explain these options:

Cheaper Flood Insurance: 5 Ways to Lower the Cost of Your Flood Insurance Premium

What is the Community Rating System?The National Flood Insurance Program's (NFIP) Community Rating System (CRS) is a voluntary incentive program that recognizes and encourages community floodplain management activities that exceed the minimum NFIP requirements. As a result, flood insurance premium rates are discounted to reflect the reduced flood risk resulting from the community actions meeting the three goals of the CRS:

|

|

The CRS classes for local communities are based on 18 creditable activities, organized under four categories:

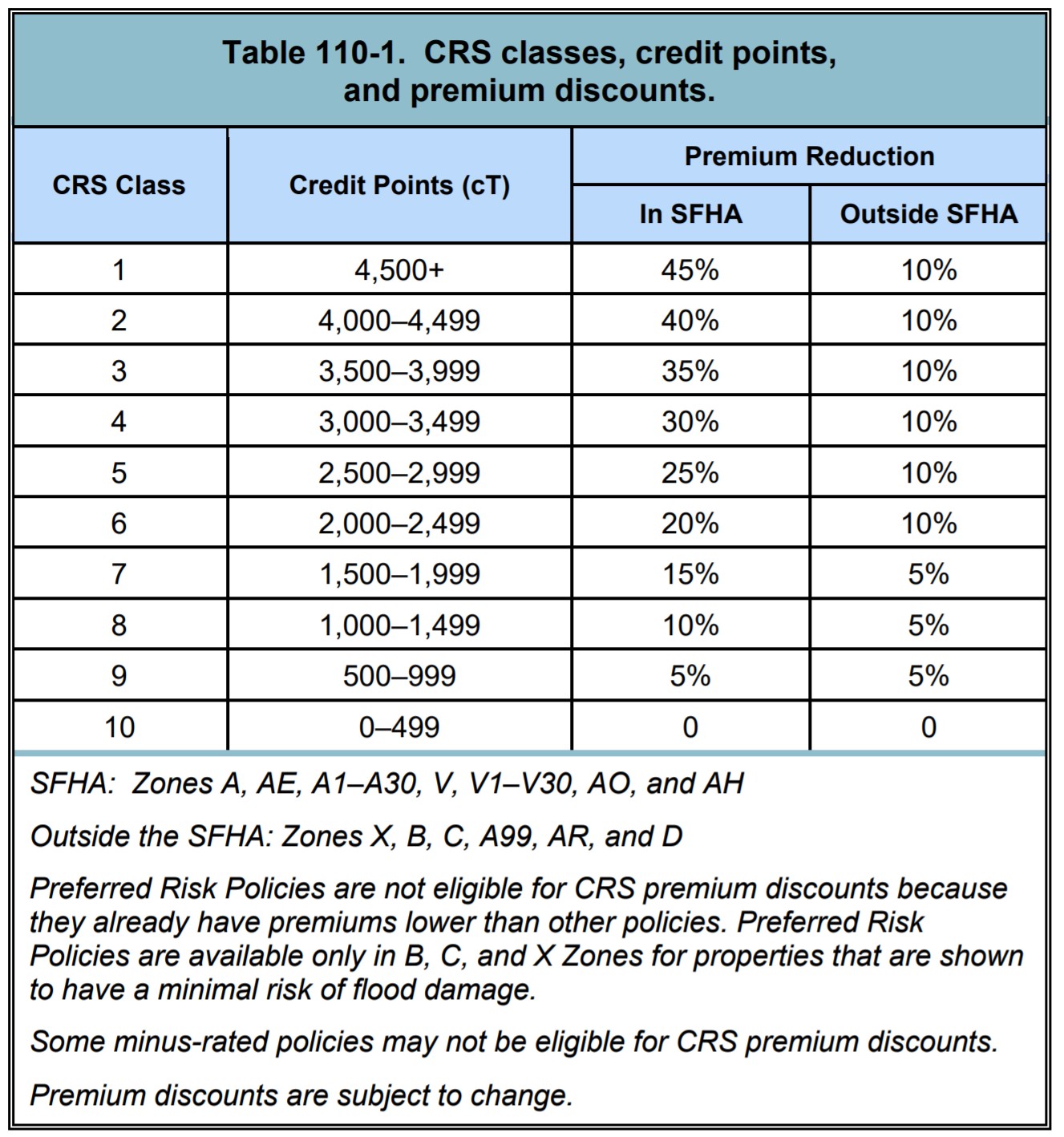

The table (left) shows the credit points earned, classification awarded and premium reductions given for communities in the NFIP CRS. Learn more about the Community Rating System: National Flood Insurance Program Community Rating System A Local Official’s Guide to Saving Lives, Preventing Property Damage, and Reducing the Cost of Flood Insurance |